operating cash flow ratio vs current ratio

The following is an example of a current ratio calculation. The current ratio equals current assets divided by current liabilities.

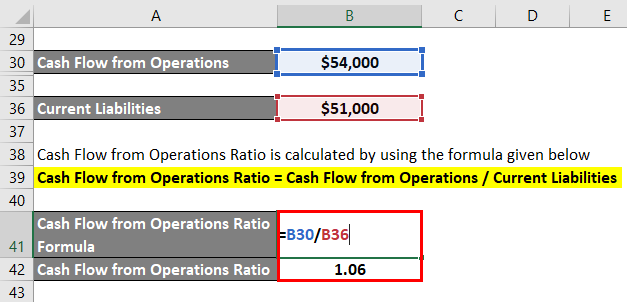

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

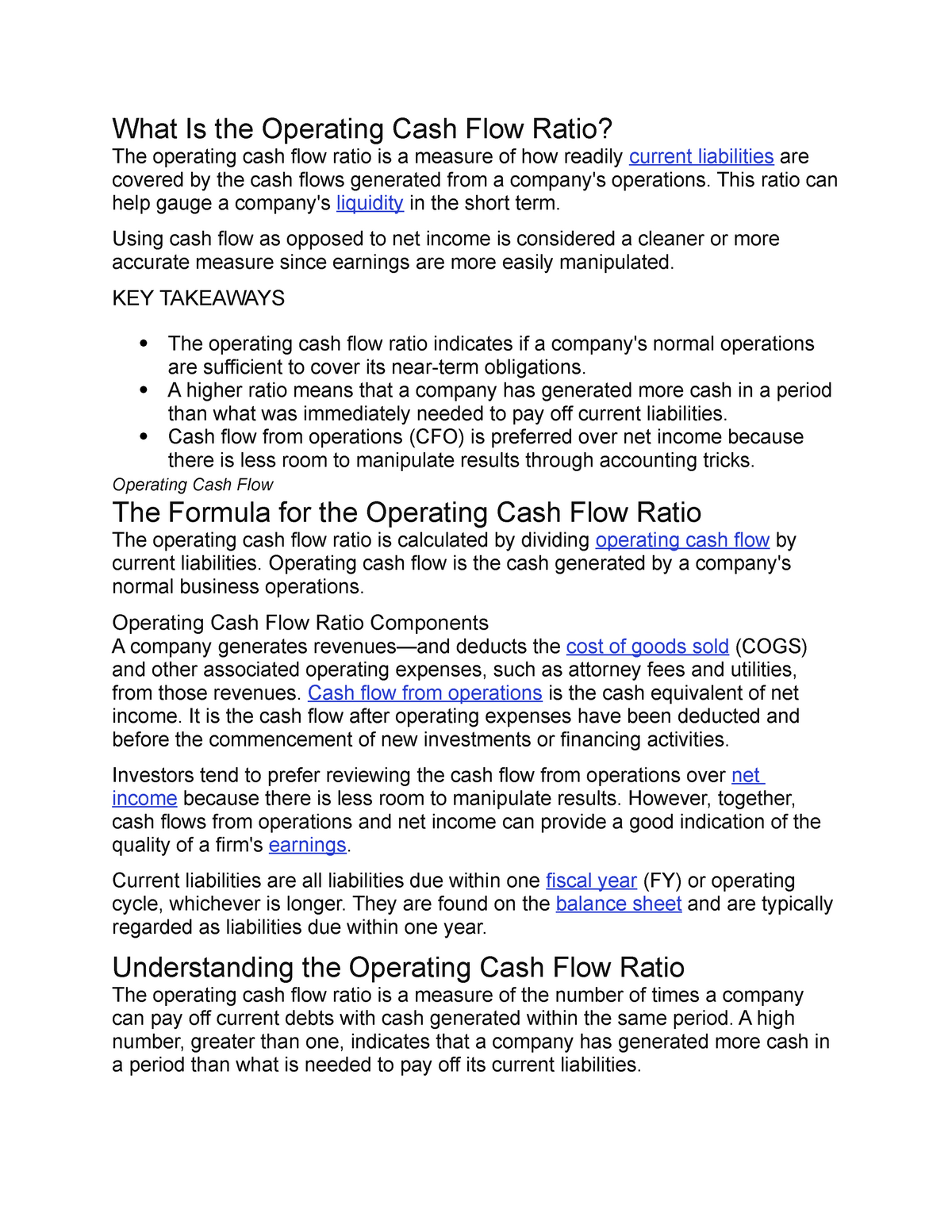

This ratio indicates the ability the businesss operations have to generate cash that.

. The current ratio and the operating cash flow ratio both evaluate a companys capacity to pay short-term debts and obligations. For Gsk Plc profitability analysis we use financial ratios and fundamental drivers that measure the ability of Gsk Plc to generate income relative to revenue assets operating costs and. Kernel Holding Cash Flow from Operations vs.

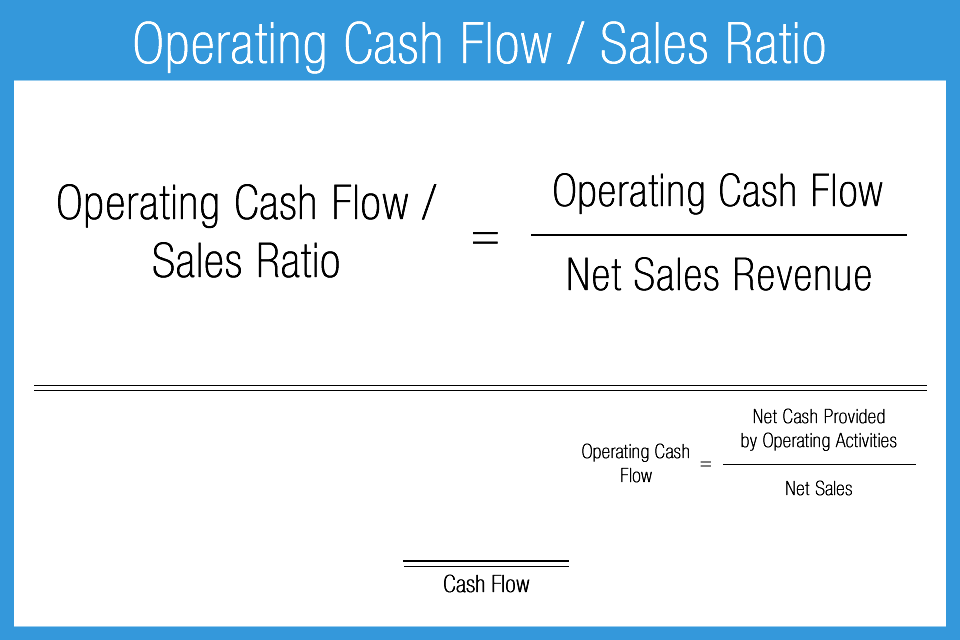

Cash Flow Margin Ratio Calculated as cash flow from operations divided by sales. It measures whether or not a company has enough cash or liquid assets to pay its. The formula for calculating this important ratio is as follows.

4 rows The only difference is that the operating cash flow ratio takes into account the cash flow. It is currently regarded as number one stock in current ratio category among related companies. Current assets Current liabilities Current ratio.

Current Ratio is calculated by dividing the Current Assets of a company by its Current Liabilities. Company can use current ration indicates a firms ability to. The current ratio of a business measures its ability to pay its current liabilities using its current assets such as cash.

Both the operating cash flow ratio and the current ratio measure a companys abilitThe operating cash flow ratio assumes cash flow from operations will be used to pay those current obligations ie current liabilities. Free Cash Flow vs. To better evaluate the financial health of a business the Operating Cash to Total Cash Ratio should be computed for a number of companies that operate in the same industry.

The operating cash flow ratio is a liquidity ratio that measures how well a company can pay off its current liabilities with cash generated from its core business. For SINOPEC SHAN profitability analysis we use financial ratios and fundamental drivers that measure the ability of SINOPEC SHAN to generate income relative to revenue assets. The operating cash flow ratio and current ratio can both be used to determine the ability of an organization to pay its current obligations.

The current ratio meanwhile assumes current assets will be used. 5 Ratios for Cash Flow Analysis Current Liability Coverage Ratio. The ratio of Cash Flow from Operations to Current Ratio for Lpl Financial Holdings is about.

The operating cash flow ratio measures the ability of a business to pay for its current liabilities from its reported operating cash flows. If this ratio is less than 11 a business is. The operating cash flow ratio assumes that current.

Operating cash flow ratio vs. A ratio of 23. The cash flow most commonly used to calculate the ratio.

The cash flow to debt ratio is a coverage ratio that compares the cash flow that a business generates to its total debt. This is a more reliable metric than net profit since it gives a clear picture of the amount of cash. It indicates the amount of cash at the balance sheet.

While calculating the operating cash flow ratio cash flow from operations are considered to pay off current liabilities while for calculating the current ratio the company.

Financial Ratio Notes What Is The Operating Cash Flow Ratio The Operating Cash Flow Ratio Is A Studocu

Cash Flow Ratio Analysis Double Entry Bookkeeping

Solved Compute And Interpret Cash Flow Ratios The Following Chegg Com

Liquidity Ratio Types Calculation Examples Layer Blog

Operating Cash Flow Ratio Definition Formula Example

Operating Cash Flow Ratio Calculator

Free Cash Flow Fcf Definition Formula And How To Calculate Stock Analysis

Liquidity Ratio Formula And Calculation

Operating Cash Flow To Sales Ratio Accounting Play

Operating Cash Flow Ratio Youtube

Christopher B Stone 01 Present Value Of Future Cash Flow R Discount Rate N Number Of Periods Discounting Calculation Of Present Values Compounding Ppt Download

What Is Operating Cash Flow Ratio Guide With Examples

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

The 10 Cash Flow Ratios Every Investor Should Know

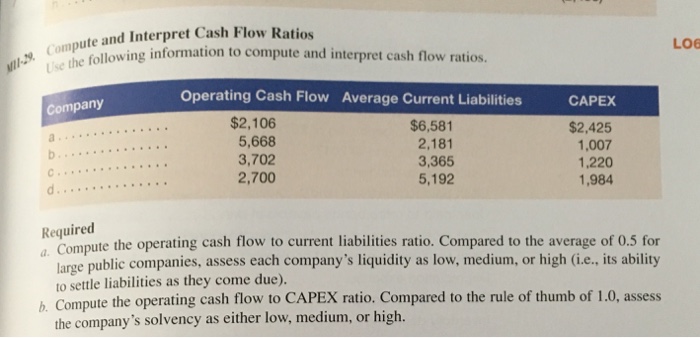

Solved Compute And Interpret Cash Flow Ratios Use The Chegg Com

6 1 Financial Statements Analysis And Long Term Planning Ppt Download